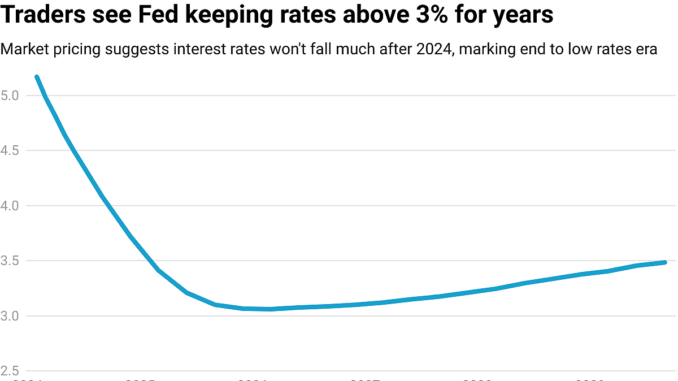

Borrowers looking for relief from higher interest rates may be set for disappointment with financial markets indicating rates will stay elevated for years to come.

However much they fall in 2024, pricing in money markets highlights a view that the decade of near-zero interest rates prevailing after the great financial crisis is unlikely to return while inflationary pressures and government spending stay high.

That risks further pain for many public and private borrowers who locked in past lower rates and have yet to feel the full impact of the record-paced central bank hikes of the last two years.

Traders have in recent weeks doubled down on bets for steep rate cuts next year, encouraged by slowing inflation and a dovish shift from the U.S. Federal Reserve.

Expectations that rates will drop at least 1.5 percentage points in the United States and Europe have boosted bond and equity markets.

That is in stark contrast to rates staying near zero for most of the decade following the global financial crisis, only gradually rising to 2.25%-2.50% in 2018.

European Central Bank rates are seen at roughly 2% by end-2026, from 4% currently – a reduction but hardly a sign of any return to the unorthodox experiment with negative rates seen from 2014 to 2022 0#FEI:.

More details

The U.S. economy so far avoiding a recession many expected in the face of aggressive policy tightening has also supported that argument.

Higher inflation risks on the back of geopolitical tensions and reshoring, looser fiscal policy and potential improvements in productivity from the likes of AI are among factors that may be lifting the neutral rate, often dubbed ‘R-star’.

Some notion of the neutral rate, though impossible to determine in real time, is key to understanding an economy’s growth potential and a central bank’s decision on how much to reduce rates going forward.

Whether the neutral rate has moved is subject to much debate and it has risen.

Crucially, market expectations are higher than the Fed’s 2.5% estimate for long-term interest rates, though several policymakers have put it above 3%.

In the euro area, ECB policymakers point to a neutral rate of around 1.5%-2%.